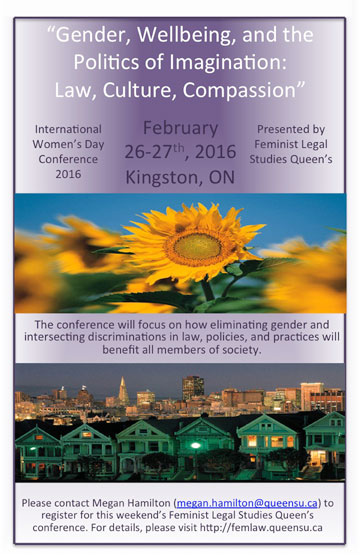

Gender, Wellbeing, and the Politics of Imagination: Law, Culture, Compassion

Queen’s University, Kingston, Ontario, Feb. 26-27, 2016

Conference Program *updated*

**Accommodations: Please book your room through this website and you’ll receive the discounted FLSQ conference rate of $119/night. Please go ahead and book using this link: Holiday Inn Kingston

** NEW**

Due to the kind support of the Law Commission of Ontario, this conference can provided students from Ontario law schools with limited support for registration and travel to attend this conference. Please contact Megan Hamilton at Megan.Hamilton@queensu.ca with the subject line FLSQ LCO Conference Support as soon as possible, and include a statement explaining why it is important to you to attend this event!

According to the Canadian Index of Wellbeing national report (CIW, 2011), despite significant increases in economic growth between the years of 1994-2008, ‘increases in the wellbeing of Canadians were not nearly comparable.’ The Index finds that ‘societies with greater inequality … have worse health and wellbeing outcomes.’ At the same time, countries like Canada have responsibility for one of the largest shares of global biocapacity, yet tolerate persistent levels of food insecurity, environmental contamination, and poverty. The CIW Provincial Report On Wellbeing, How are Ontarians Really Doing? (2014), found that Ontarians have even lower levels of wellbeing than in the rest of Canada.

Improved wellbeing and better futures are political, cultural, sociological, and economic issues as well as legal issues. Law is not the only site of political struggle. Imagining better futures is a collective social process. Institutional transformation, law reform, and improved wellbeing demand moving toward moral imaginations focused on equality, diversity, and participatory governance.

Over twenty years ago, the Beijing Platform for Action was adopted at the United Nations Fourth World Conference on Women to secure active state engagement in bringing all laws, policies, and practices into compliance with the Convention on the Eradication of Discrimination against Women, to which Canada is signatory. Since then, the Organization for Economic Cooperation and Development (OECD) has also come to advocate wellbeing policies. In order to accelerate this discussion, the 2016 FLSQ International Women’s Day conference will focus on how eliminating gender and intersecting discriminations will benefit all members of society.

Registration, accommodation, and childcare:

Attendance without presenting a paper is welcome. Contact the organizers to indicate interest and obtain registration information. Some funding is available to assist students to attend. Registration

will open on January 15. Information on accommodation will be provided on request. Anyone wanting childcare should mention this request so appropriate arrangements can be made.

For further information please contact:

Prof. Kathleen Lahey, Co-Director

Feminist Legal Studies Queen’s

Faculty of Law, Queen’s University

Kingston, Ontario

kal2@queensu.ca

Prof. Bita Amani, Co-Director

Feminist Legal Studies Queen’s

Faculty of Law, Queen’s University

Kingston, Ontario

amanib@queensu.ca

Women and Tax Justice at Beijing+20:

Taxing and Budgeting for Sex Equality

Feminist Legal Studies Queen's, Women for Tax Justice, FemTax International, Canadians for Tax Fairness, Faculty of Law, Queen's University, and SSHRC

Registration: melissa.howlett@queensu.ca

Program PDF

Background Reading: Tax Abuses, Poverty and Human Rights

Friday, Mar. 6, 2015

11:30 Registration - Robert Sutherland Hall, Policy Studies, 138 Union St.,

Kingston, Ont., room 202 (main floor) - light lunch provided

12:20 Welcome and introduction to conference themes

Bita Amani, Faculty of Law and Co-Director, Feminist Legal Studies Queen's

Queen's University

May Hen, Co-Director, Women for Tax Justice, University of the Caymans

Åsa Gunnarsson, Forum on Law and Society and FemTax, Umeå University, Sweden

Kathleen Lahey, Faculty of Law and Co-Director, Feminist Legal Studies Queen's, Queen's University

1:00 Keynote address: Attiya Waris, School of Law, University of Nairobi, Kenya, Faculty of Law, University of Rwanda, and Queen's University Principal's Development Fund International Visitor - Rights of Women and Taxation: Developing Country Perspectives'

2:30 Break

2:45 Panel I The Role of Tax Law in Constructing Global Value Chains

David Quentin, Barrister (UK) and Tax Justice Network -

'Tax Anatomy of International Value Chains'

Alexandra Diebel, Faculty of Law, University of Ottawa, JD/LLL program, formerly transfer pricing consultant and researcher -

'Tax Justice, International Tax Structuring, and "Beneficial Ownership"'

Erika Dayle Siu, Lawyer (NY) and Tax Policy Analyst, International Centre for Taxation and Development, University of Sussex -

'Tax Justice for Sustainable Development: The International Commission on

Reform of International Corporate Taxation'

4:00 Panel II Women Entrepreneurs, Taxation of "Informal" Businesses, and Government Austerity Regimes

Adetoun Ilumoka, Solicitor and Advocate (Nigeria), PhD University of B.C. (2014), Daryl Bean Professor of Law and Women's Studies, University of Western Ontario (2010-12), currently AOIA Consultancy Services --

'Unfair Taxation, Violence, and the Quest for Gender Justice in Nigeria: Changing the Discourse'

Ana Androsik, Program Advisor, World Vision; recently Consultant, European Network of Experts on Employment and Gender (EGGE)/European Commission;

PhD economics program, New School for Social Research, NY --

'Women Entrepreneurs in Post-Conflict Kosovo and Fiscal Austerity Policies'

6:00 Dinner and Networking Discussions, Information

Women for Tax Justice, Tax Justice Network

FemTax International, the EC FairTax project

Canadians for Tax Fairness, Parkland Institute

Saturday, March 7, 2015

8:30 Registration --Robert Sutherland Hall, Policy Studies, 138 Union St.,

Kingston, Ont., room 202 (main floor) - breakfast provided

9:00 Panel III Global Value Chains and the Value of Women

Nabila Khan, Osgoode Hall Law School, York University, JD program,

International Women's Rights Project and Bangladesh Legal Aid and

Services Trust -

'Rana Plaza, Global Supply Chains, and Offshore Manufacturing: Gender

Issues and Effects'

May Hen, Co-Director, Women for Tax Justice, and Researcher, University College of the Cayman Islands, Centre for Policy Research, Simon Fraser University, and Department of Anthropology, University of California Irvine -

'Mapping Women in Offshore Financial Industries: The Cayman Islands Experience'

10:00 Break

10.15 Panel IV Women, Taxation, and Gender Budgeting: Visions and Challenges

Evelyn Palach, Faculty of Law, Queen's University, JD program -

'Gender Budgeting, Extreme Poverty, and Tax Issues'

Ximei Wu, Professor, School of Law, Zhengzhou University, China; Visiting Scholar, School of Public Policy, University of Calgary -

'Social Gender Budgeting in China: Review and Prospects'

Paloma de Villota, Professor of Applied Economics, Faculty of Political Science, Complutense University, Madrid, Spain, and Ignacio Ferrari, former Vice Director of Tax Policy, Ministry of Finance of Spain --

'Gender Budgeting from the Capabilities Approach in Spain: Applications and Methodologies'

Ulrike Spangenberg - Researcher, Forum for Studies on Law and Society, Umeå University, Sweden, Institute for Gender Equality, German --

'Gender-based Analysis of Tax Legislation: Implementation and Impact in Germany'

11:45 Lunch

1:00 Panel V Gender and Social Reproduction: Unpaid Work Traps in Tax and Spending Programs

Kira McCutcheon, Global Development Studies, Queen's University --

'Feminist Political Economy and Social Reproduction: The Gender Impact of World Bank Policy on Ontario Compassionate Care Law'

Asa Gunnarsson, Professor, Forum on Law and Society, Umeå University --

'Taxing for Gender Equality in Women-Friendly Welfare States'

Ann Mumford, Reader in Law, Dickson Poon School of Law, King's

College London --

'Unpaid Labor, the UK's Universal Credit, and the Taxpayer State'

Kathleen Lahey, Professor, Faculty of Law, Queen's University -

'Taxing Women as Individuals: The Difference Equality Makes'

2:30 Break

2:45 Panel VI Gender, Equality, and Development Challenges:

The Future We Want

Leonel Cesarino Pessoa, Professor, University Center FMU, Researcher, Getúlio Vargas Foundation São Paulo College of Law, and Brazil --

'Defending Human Rights in Brazil: Fiscal Challenges in the Taxation of Civil Society Organizations'

Nicole McDonald, Faculty of Law, Queen's University, JD program -

'Taxation and Poverty in Nunavut: Policy Alternatives'

Meenal Shrivastava, Professor and Academic Coordinator, Global Studies and Political Economy, Athabasca University, Alberta --

'Oil, Inequality, and Democracy in the Global North and South'

Sheila Regehr, Chair, Basic Income Canada Network, former Executive Director of the National Council of Welfare -

'Basic Income and Gender Equality: Reflections on the Potential for Good Policy'

4:00 Closing discussion: followup plans, actions, publications

Dennis Howlett, Executive Director, Canadians for Tax Fairness -

'Financing for Development and the Post-2015 Development Agenda: How to be Heard in Addis'

Queen's University sits on the traditional lands of the Haudenosaunee and Anishinaabe peoples